Check out any time you like, but you can never leave

Just six months after selling its net lease platform Fundamental Income to Starwood Property Trust (NYSE: STWD), Brookfield Asset Management (NYSE: BAM) has ‘reentered the chat’ in single tenant net lease via the public markets.

Peakstone Realty Trust (NYSE: PKST) announced that a private real estate fund of Brookfield will acquire the REIT in a take-private at $21.00 per common equity share.

The all-cash consideration implies a ~$1.2 billion enterprise value. As a rebranded former Griffin non-traded REIT, Peakstone listed on NYSE in 2023 - a full 14 years after its initial launch.

Peakstone’s recent activities involved an exit from office assets and aggregation of so-called IOS (industrial outdoor storage) properties. Our upcoming February issue of the Net Lease Observer will dive into the history of this complex story.

Sub-5 five year

STORE Capital announced the pricing of a $450 million offering of 4.95% senior unsecured notes due February 2031 at 99.95% of par. Net proceeds from the raise are intended “to repay indebtedness and to fund property acquisitions.”

First in the clubhouse

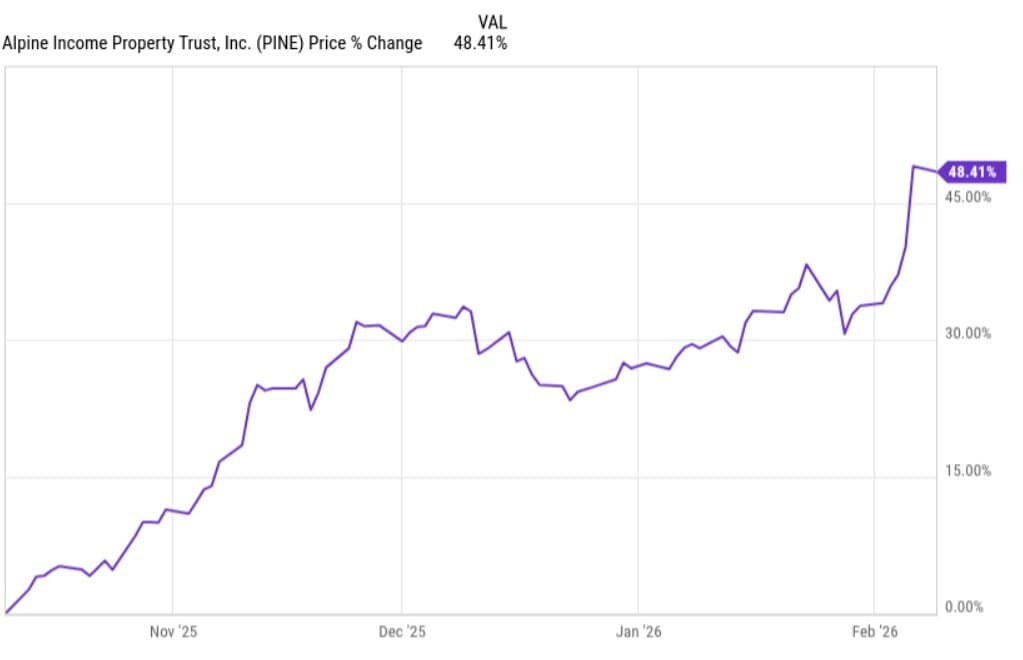

Alpine Income Property Trust (NYSE: PINE) is the first net lease REIT to report 4Q and full year 2025 earnings. Since early October, common shares have appreciated by nearly 50%…

Source: Y-Charts

At least nine (9) net lease REIT report later this week!

Check out our tear sheet summary on PINE here:

Subscribe to read the rest.

Become a paying subscriber of the Net Lease Observer to get access to this post and other subscriber-only content.

Upgrade