[A]growth story at Agree

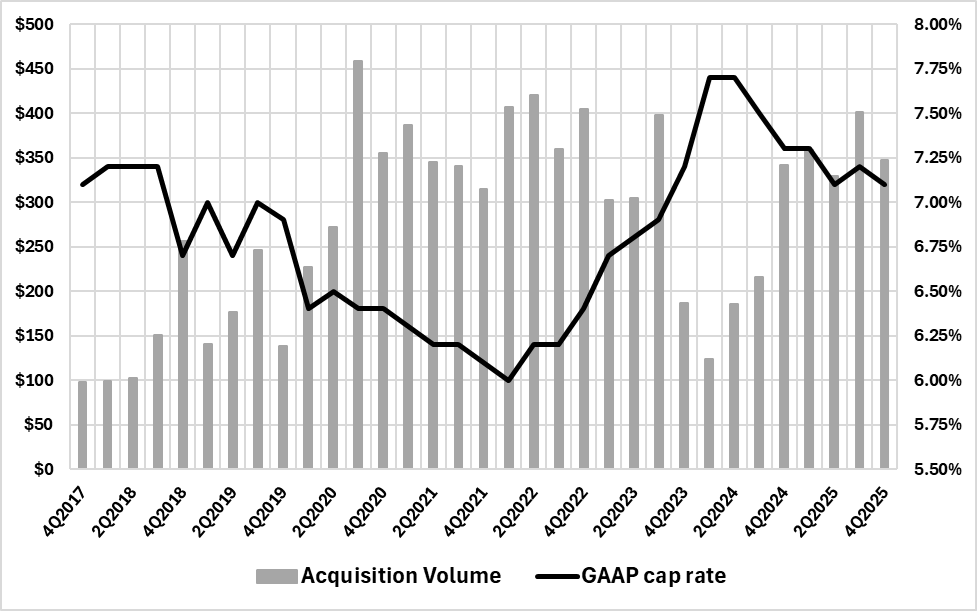

2025 investment volume at Agree Realty (NYSE: ADC) totaled $1.55 billion with 93% ($1.44 billion) via traditional acquisitions across 305 retail properties. Acquisitions were completed at a 7.2% GAAP (straight line) cap rate. While volumes have returned to near historic high levels since the late 2023/2024 slowdown, straight-line yields have compressed since peaking in early 2024.

Quarterly acquisition volume and GAAP cap rate; Source: Company filings; Dollars in millions

Meanwhile, while both weighted average lease term remaining (WALT) and investment grade rated tenancy of acquisitions have generally fallen as the REIT grows, ADC’s credit tenancy remains sector leading (65% for full year 2025) and new deals often include over 10 years of lease term.

Source: Company filings; Left: WALT; Right: IG-rated annualized base rent

Agree provided investment volume guidance of $1.25-1.50 billion for full year 2026.

Subscribe to read the rest.

Become a paying subscriber of the Net Lease Observer to get access to this post and other subscriber-only content.

Upgrade